According to a recent post written by economist Rishi Sondhi for TD Economics, Canada’s cooling real estate market continued to slow in July. However, the slow decline in July wasn’t as sharp as June. Naturally a thin lining of tarnished silver like this could prompt many investors, market-watchers and homeowners to polish up their crystal balls for clairvoyant speculation, but in this article we’ll focus on the numbers.

Regional Trends Don’t Differ Much From National Trends

The national snapshot is that home sales across the country are declining “falling 5.3% month-on-month (m/m) to 37.6k units (marking the lowest level for sales since May 2020)” and similarly for average home prices which have declined 3.1% m/m. The Canadian Real Estate Association has attributed this cooldown to timing, after a feverish year of sales filled with bidding wars and homes going for above asking.

In the Greater Toronto Area, home sales have decreased 24% from June – and almost 47% from last year. Indeed, all housing types ranging from detached homes to townhomes and condos have seen reductions in both sales and prices. Per the Toronto Regional Real Estate Board (TRREB) data, average resale home prices show a downward trend to near-parity with the present July 2022 average being only 1.3% more than July 2021 average price. This is quite significant as it is largely undoing the big increases of early 2022. Upon further examination of home prices on a more local basis, it is apparent not all regions within the Greater Toronto Area experienced the same reductions. For instance, the biggest price drop was in King township, where prices fell $178,200 lower between June and July.

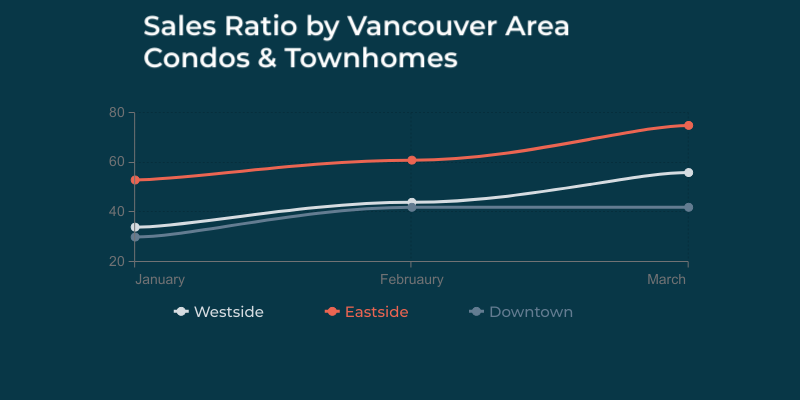

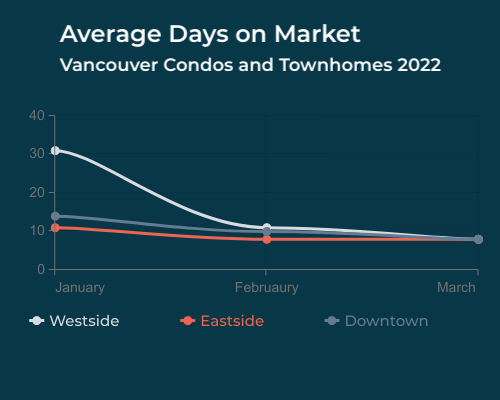

In July 2022, detached homes on the Vancouver Westside saw a sharp decrease in sales amounting to a 33% reduction in sales. Similarly, the Eastside of Vancouver saw a 30% reduction in sales from June to July. This noticeable change was reflected in the sales of condos & townhomes as well where both Vancouver’s Downtown and Westside areas saw reductions in sales at 17% and 22%, respectively. Vancouver Eastside proved more resilient at 27% – albeit still a reduction from June 2022. In the Vancouver Eastside, condos and townhomes priced $500k – $800k sold particularly well at a 35% sales ratio. This preference among buyers is likely a reflection of the broader economic factors currently affecting prices and sales of all property types.

Mounting Anxieties & Burdens Produce a Mountain like Everest

The usual suspects of this decline (interest rates, inflation, global financial chaos) have been thoroughly named and blamed with each successive month of sales decline, price fluctuation and market correction. Why should this month be any different? Since variable rate mortgages are being stress tested more thoroughly than before, this can make market entry for potential homebuyers much more difficult – which in turn leads to lower sales and potentially lower sale prices. According to Ratehub.ca, the average annual income required to purchase a home has “increased significantly” to $18,000 in the preceding four months. Compared to March, homebuyers would have to earn additional income ranging $8,660 to $35,760 to buy a home in June.

And this amount varies depending on the region too.

If you were a homebuyer in British Columbia’s capital city of Victoria, per Ratehub.ca’s data, you would need an additional $35,760 added to your income. In Vancouver, noted for its high cost of living and real estate, the increase is $31,730. For Toronto, the additional amount is less at $15,750 – although the income required would still be $226k on top of a $963k mortgage.

What makes this turn of the real estate market interesting is how these stressors are coming at both sides of the transaction, affecting both sellers and buyers by making their symbiotically-linked, diametrically-opposed objectives that much harder to achieve. Sellers want the best possible price for their home and in the right time frame, but buyers are having trouble raising funds to close the deal and are trying to find the right price point at the right time. (Of course, finding the right realtor can certainly help buyers and sellers navigate tricky markets.) At some point, this downward trend will have to stop, but even that timing and its implications remain unclear.

Yeah, But… Renting Isn’t Affected By All This Tumult, Right?

Unfortunately, renting is affected by inflation and rate increases too.

In Toronto, the average rent for all property types has increased “19% year-over-year, for an average $2,403 per month compared to $2,018 per month in June 2022.” Adding to this, the monthly rental price grew in June 2022 by 3.1%, only slightly down from the 5.7% growth in May. When examining the differences between the average rent for condos and the average monthly mortgage payments for condos, the price difference (which can vary widely) in Toronto and the GTA can be anywhere from -14.4% or -10.2% (meaning it is cheaper to own than to rent) or up to 59% over renting. Further compounding this , in July Ontario had the second-highest average among provinces in Canada at $2,232 – a 15% annual increase.

The unpleasant accolade of highest-rent went to British Columbia, which stood at $2509.

Thus it is expected that the situation in Vancouver is much the same as the average rent for a 1 bedroom, unfurnished apartment has steadily increased month-to-month since March. Much like Toronto, the increases (and decreases) vary greatly across the Lower Mainland’s various municipalities, such as a 24% rent increase for unfurnished units in Richmond, but a -3.77% reduction in North Vancouver. These rent increases can pose challenges for renters in Metro Vancouver, an area already associated with a high cost of living.

The Bottom Line

Canada’s real estate market is experiencing a decline for about four months now, but it could be worse and we are not alone. Canada is experiencing much of the same economic uncertainty and instability as other countries – and often to a lesser extent. In China, house prices have continued to fall for 11 months straight. In the European Union, housing prices are increasing, with the biggest increases in Hungary posting 19% increases on new homes and 20% increases on ‘second-hand’ homes. For the most part the American housing market is cooling too, although if you’re in Elkhart-Goshen, Indiana you are living in the hottest housing market in the country. Elkhart-Goshen is also where 80% of the world’s RVs are produced.

Jack Kaufman isn’t necessarily interested in the mobile lifestyle. Not ruling it out though.